Regional Property Market Update Spring 2021: West Midlands and Wales region

At 6.9% and 7.0% respectively, average annual price growth in the West Midlands and Wales is slightly lower than the UK average. In the West Midlands growth is currently stronger than at any point since summer 2016, in Wales since before the Global Financial Crisis. In eleven areas growth currently exceeds 7.5%. Although Rightmove report a slight fall in asking prices month on month, properties are selling more quickly than a year ago.

Annual price growth has strengthened across the UK in recent months

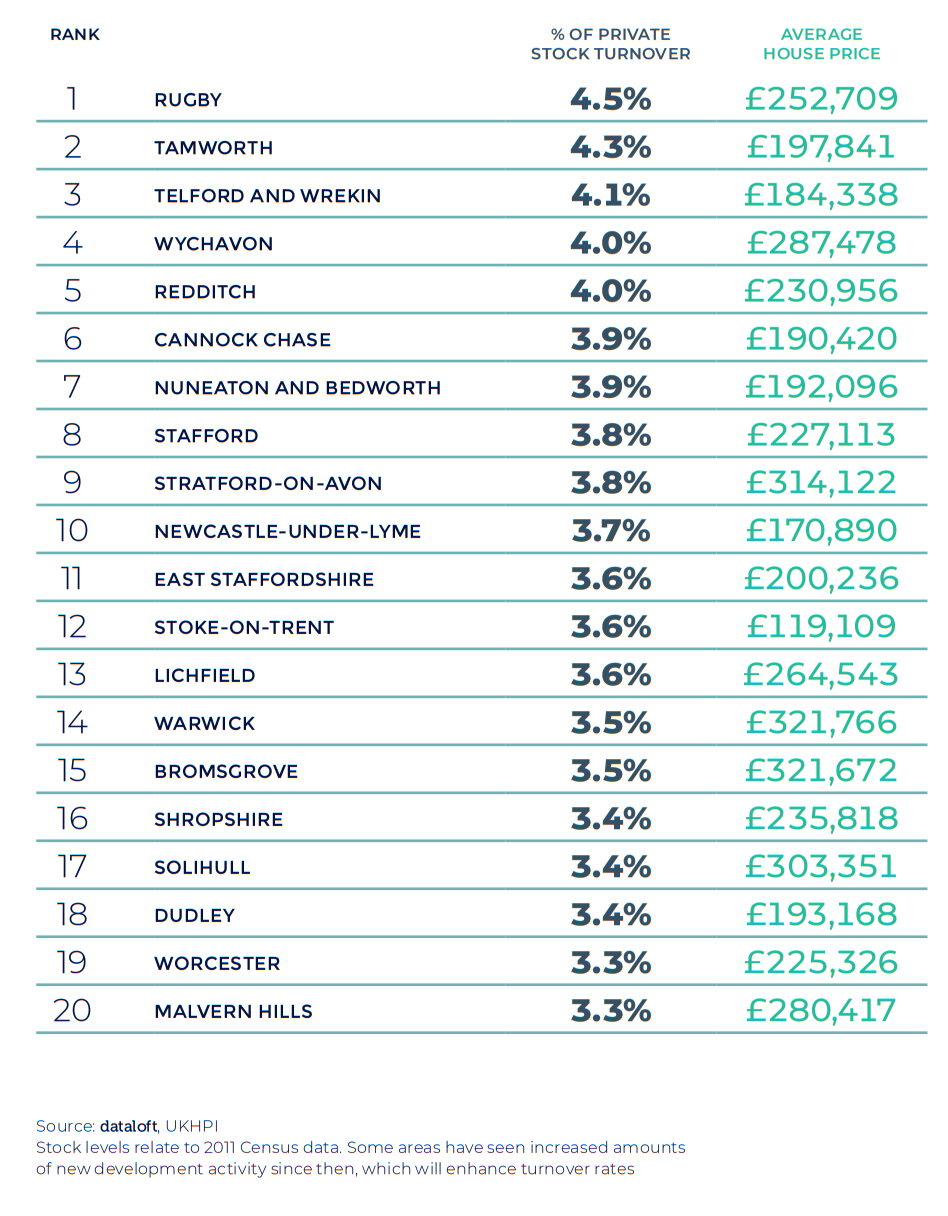

Most active housing markets across the West Midlands and Wales region

Average property prices in the West Midlands and Wales are more expensive than a year ago and activity across the market is robust. On average 3.3% of private properties are sold each year, with turnover in five areas currently 4% or above. Over 15,400 new homes were registered for sale during 2020, and nationally registrations have been on an upward trend since September.

First-time buyers were particularly affected by the closed housing market and the stricter mortgage lending that followed. However, buyer numbers have recovered steadily, with transactions just 2% lower year on year during the final six months of 2020 (UK Finance). The number of High Loan-to-Value (LTV) mortgage products has also increased, Moneyfacts reporting there were 169 products available at 90% LTV in January, over double the number available back in July. Lending rates remain low, the average mortgage rate the lowest in history.

Contact us

If you want independent guidance on moving home or are looking for the best agent in your area, find your local Guild Member today.